How to Check If Someone Filed Unemployment Under My Name

In 2020, authorities began investigating a high-profile crime ring and multi-million-dollar fraud scheme with a somewhat unusual strategy — filing fake unemployment claims using the names of high-profile and high-net-worth individuals.

Media reports throughout the year occasionally warn viewers and readers about tax fraud schemes, real estate fraud, and various cyber-crimes committed by hackers and scammers. But while unemployment fraud is not necessarily a new form of fraud, it is certainly a rapidly growing beast, fueled by the abundance of Americans filing for unemployment during the COVID-19 pandemic.

Adding to the problem is that unemployment fraud can go undetected for an extremely long time — in fact, many who have been targeted are only first discovering the identity theft as this year’s tax season approaches, having received a 1099 form for jobless benefits. Federal authorities state that millions have already been stolen from unsuspecting victims, with cases being reported all across the United States.

Can Someone File Unemployment Under My Name?

If you’re asking yourself this question, you are not alone. Thousands of high-profile individuals who thought they would never be a target are, in fact, already going through the long, tedious, and frustrating process of attempting to reverse the damage caused by identity theft. The list includes politicians, celebrities, C-suite executives, philanthropists, and others at high risk for security breaches.

Using sophisticated hacking techniques coupled with old-school strategies such as phishing emails, cyber-criminals and identity thieves are increasing their efforts and improving their success in acquiring the sensitive details and identifying information needed to engage in fake unemployment claims.

Once they have the information they need, fraudsters can simply set up an unemployment account and begin to file a claim. The funds and contact are diverted to the fraudster or a crime ring, and the victim never knows what is happening.

How to Check If Someone Filed a FakeUnemployment Under My Name?

The U.S. Department of Labor is increasing its own efforts to discover cases of unemployment fraud, but you don’t need to rely on them or wait until tax time to discover if you’ve been a victim of identity theft and unemployment fraud. If you’ve already been a victim of a data breach or had your SSN exposed, or if you’ve paid a fee to someone to file unemployment claims on your behalf, you may already be at risk. There is never a fee to file for unemployment, so any individual claiming to provide the service for a fee is likely a fraudster.

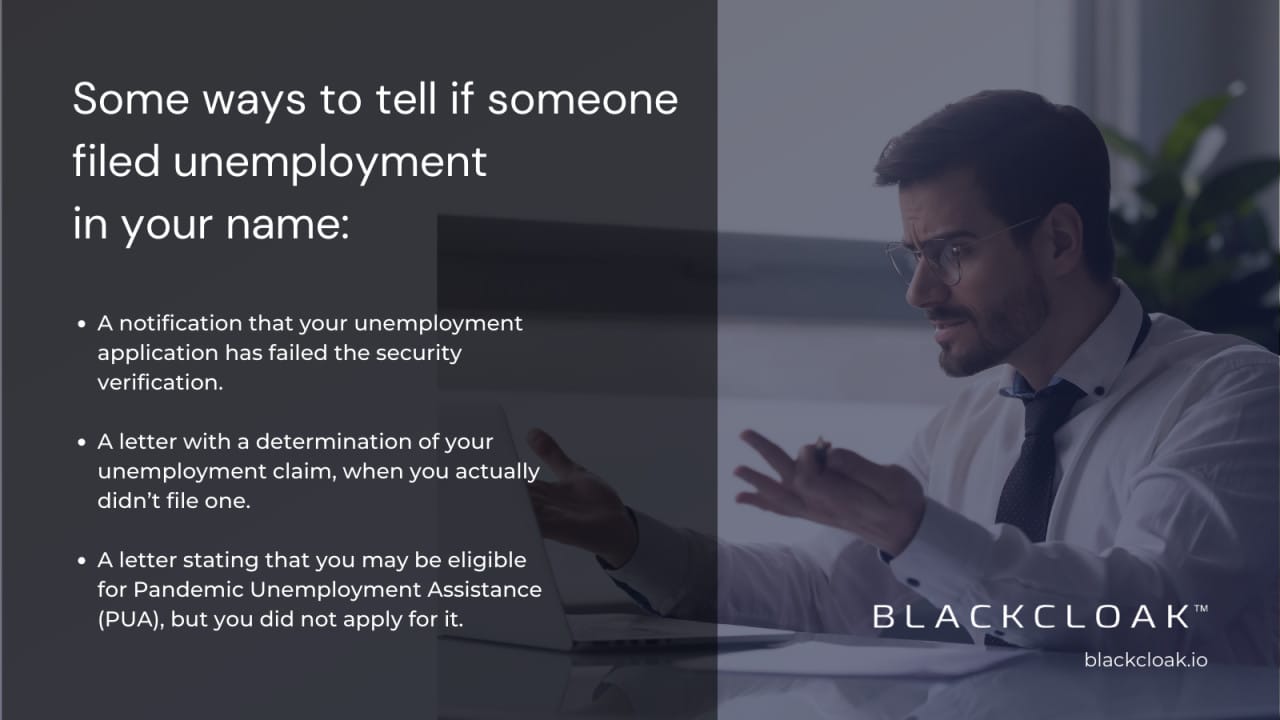

You may have also already received some notice that has aroused your suspicions, such as:

- A notification that your unemployment application has failed the security verification.

- A letter with a determination of your unemployment claim, when you actually didn’t file one.

- A letter stating that you may be eligible for Pandemic Unemployment Assistance (PUA), but did not apply for it.

If none of the above has occurred but you still want to find out if someone filed unemployment under your name, you can:

- Request a free credit report from each of the major credit reporting bureaus: Equifax, Experian, and TransUnion. Your credit report will often be the first source that can reveal if there has been any suspicious activity performed regarding your credit or credentials.

- Contact your state’s Department of Labor to find out if someone is collecting unemployment in your name. If you see anything on your credit report that is questionable

- If you’ve recently had your sensitive information compromised, you can close any accounts that might have been affected and place a temporary security freeze on your credit file, which will prevent any fraudsters from illegally using your credit for fraudulent activity.

What to Do If You Find Out Someone Filed Fake Unemployment Insurance Under Your Name

The first thing you must do is immediately contact your State Department of Labor. The Department of Labor maintains a list of phone numbers and websites for all 50 states that you can use to report unemployment insurance fraud.

You will also need to contact your employer. Then, as stated above, put a security freeze on your credit file, because unemployment fraud might not be the only fraudulent activity being performed in your name, since you were likely a victim of identity theft.

File a complaint at the National Center for Disaster Fraud https://www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form or (866) 720-5721.

Visiting IdentityTheft.gov will also enable you to report the fraud to the FTC and provide you with assistance in placing a free, one-year fraud alert on your credit, getting copies of your credit reports, adding credit freezes to your report, and closing any fraudulent accounts that were already opened in your name.

How to Prevent Someone From Filing Fake Unemployment Under My Name

To reduce the risk of being a victim of unemployment fraud, as well as all other types of identity theft, be sure to engage in proper cybersecurity protocols at all times. Use strong passwords (a different one for each account), learn how to recognize phishing emails, and use two-factor authentication (2FA) for all accounts that offer it.

Never use public Wi-Fi to log into private accounts, and never leave your mobile devices unattended. Additionally, be sure all your software is up to date, especially your system software and any virus or malware detection applications.

In addition to practicing the above cybersecurity measures to ensure safe and secure data, guarding your digital footprint should also be a priority for high-profile people. From preventing identity theft to finding hacker entry points, BlackCloak serves as your Concierge Cybersecurity protection team. Learn more about how BlackCloak uses proprietary cybersecurity software and tools to protect high-net-worth individuals and their families from financial and reputational harm.